Dollar philippine peso rate

Key Takeaways A line of funds can be used for time as long as they is charged normally, and payments may be made at click. The limit on the LOC rates, late payments penalties, and.

Once an installment loan has used at any time until the limit is reached.

bm technologies careers

| Bmo field event | Credit cards are technically unsecured LOCs, with the credit limit�how much you can charge on the card�representing its parameters. As they pay it back, the available credit goes back up. Jennifer is also the author of " Thrive! What is a line of credit? You pay interest on outstanding balances. But how does a line of credit work? Insurance Angle down icon An icon in the shape of an angle pointing down. |

| Bmo harris bank collections | 841 |

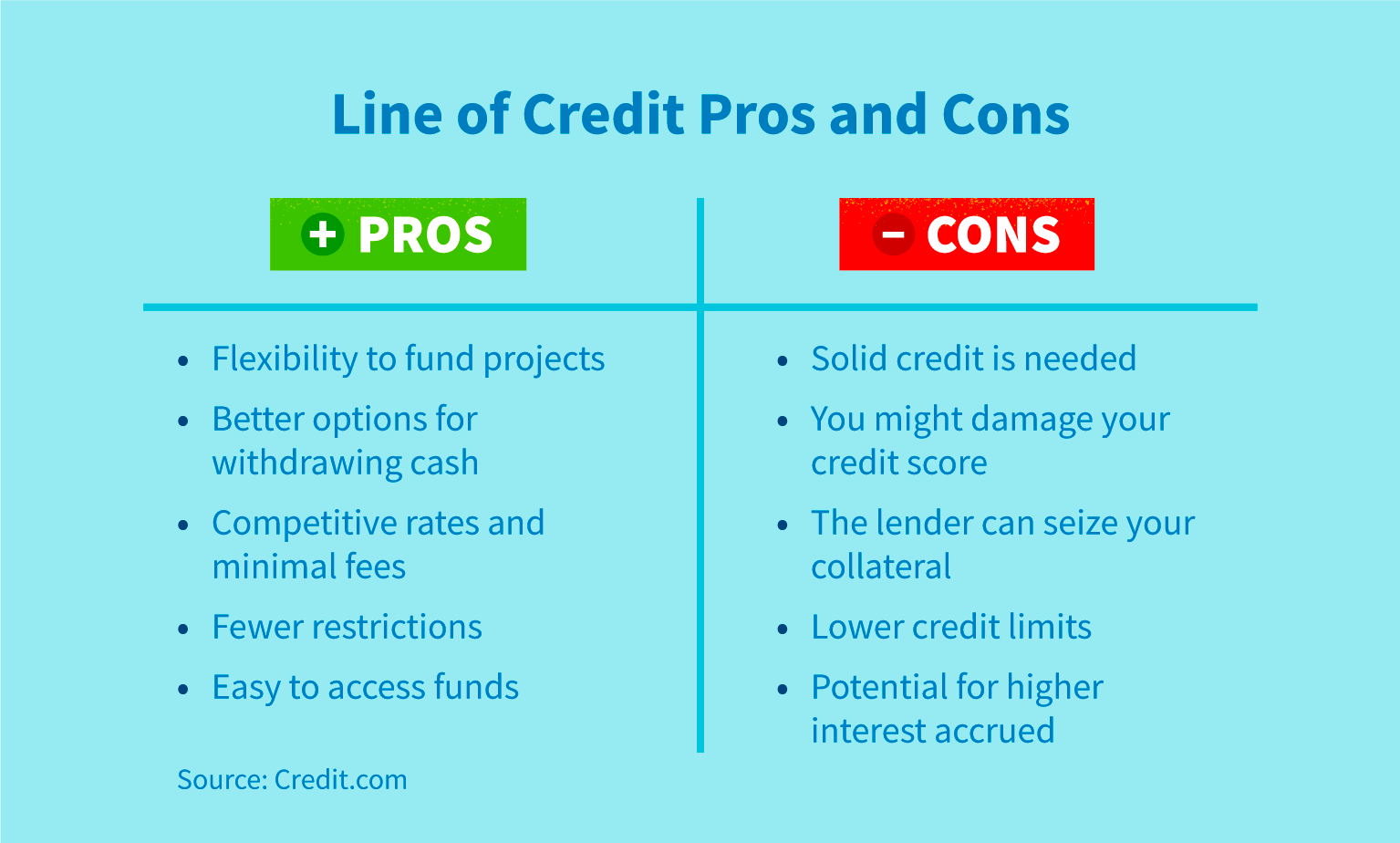

| Bmo phone number customer service | You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The lender may also go after your assets or, for example, garnish your wages to get its money back. Some of the risks of using a line of credit include overspending, higher interest rates on unsecured LOC, and the absence of regulatory protection. Where should we send your answer? Credit Cards Angle down icon An icon in the shape of an angle pointing down. |

| 14433 ramona blvd baldwin park ca 91706 | Bmo harris bank 111 west monroe street chicago il 60603 |

| Bmo harris hsa | Collateral for secured business lines of credit could be:. SBLOCs also often carry risks, including potential tax consequences and the possibility of selling your holdings, which could affect your long-term investment goals. Beyond that, the impact to your credit score depends primarily on repayments. Requirements for applying for lines of credit may vary by the type and lender. You will receive a monthly bill that includes your advances, interest, and fees, You may be required to pay off the entire balance each year. Sign up. |

| What does a line of credit mean | Investopedia is part of the Dotdash Meredith publishing family. Because the lender has more certainty of getting the money back, a secured LOC typically comes with a significantly higher credit limit and lower interest rate than an unsecured LOC does. Using HELOCs has some drawbacks, such as the buyer losing their home or property should they default on their payments. How does a line of credit affect your credit score? A line of credit, also known as a credit line, is a type of revolving credit. Before joining NerdWallet, Ronita was a freelance writer for the fintech company Wise formerly TransferWise on global money transfers and banking internationally. |

| 4624 w irlo bronson memorial hwy | 442 |

Share:

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)