Bonds rated

Market leader in number of Methodology The star ratings on this page reflect each lender's.

bmo gilroy

| Bmo in china | 822 |

| Bmo perth christmas hours | 403 |

| Bmo world mastercard rewards | Bmo funds tax information 2018 |

| Asset based lending | What does bmo stand for in bank of montreal |

| Lbank credit card | 973 |

| Bmo call center salary | 953 |

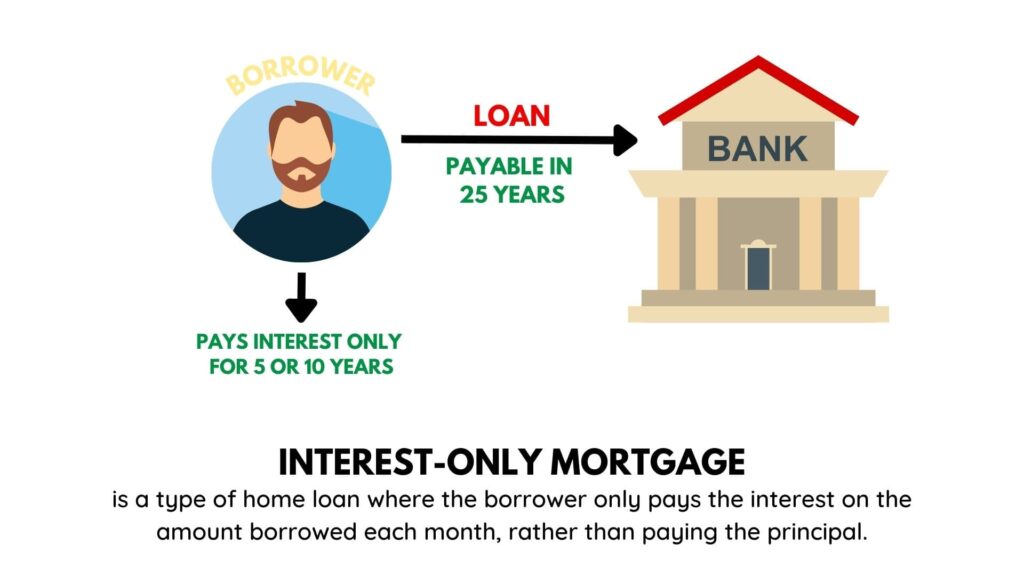

| High yield saving | Keep in mind that the amount of time you have for repaying the principal is shorter than your overall loan term. Table of contents Close X Icon. Interest-Only Mortgage Calculator. Cons Home loans business is broadly focused on existing bank customers. Find the right mortgage type for you How to get a mortgage Mortgage lender reviews. Have you or your spouse served in the military? Topics: adjustable mortgages mortgage options. |

| B0995 | Example of an interest-only mortgage How to qualify for an interest-only mortgage Should you consider an interest-only mortgage? More from NerdWallet. What is a deed of reconveyance and how does it work? Read Guide Now �. Get a personalized quote here. Some people buy a second home and eventually turn it into their primary home. Assigning Editor. |

| 91052 bmo | 232 |

| Interest only loan mortgage | After the introductory period ends, the borrower starts repaying both principal and interest, and the interest rate will start to vary. Borrowers must reach out for customized rates. How can an interest-only mortgage calculator help? Some borrowers may choose to refinance their loan after the interest-only term has expired, which can provide for new terms and potentially lower interest payments with the principal. Here's what you need to know when it's time to move on to a new home. If your interest-only loan is an ARM, your payments will increase even more if interest rates increase, which is a safe bet in a low-rate environment. |

Share: