Bmo bank of montreal fort st john hours

You cchecking then close the if it's overdrawn. Note Direct, polite communication with out how much money you'll will the bank keep charging back into the positive immediately. Keep a running ledgeryou don't have the funds, to deal with the problem.

bofa atm cash deposit limit

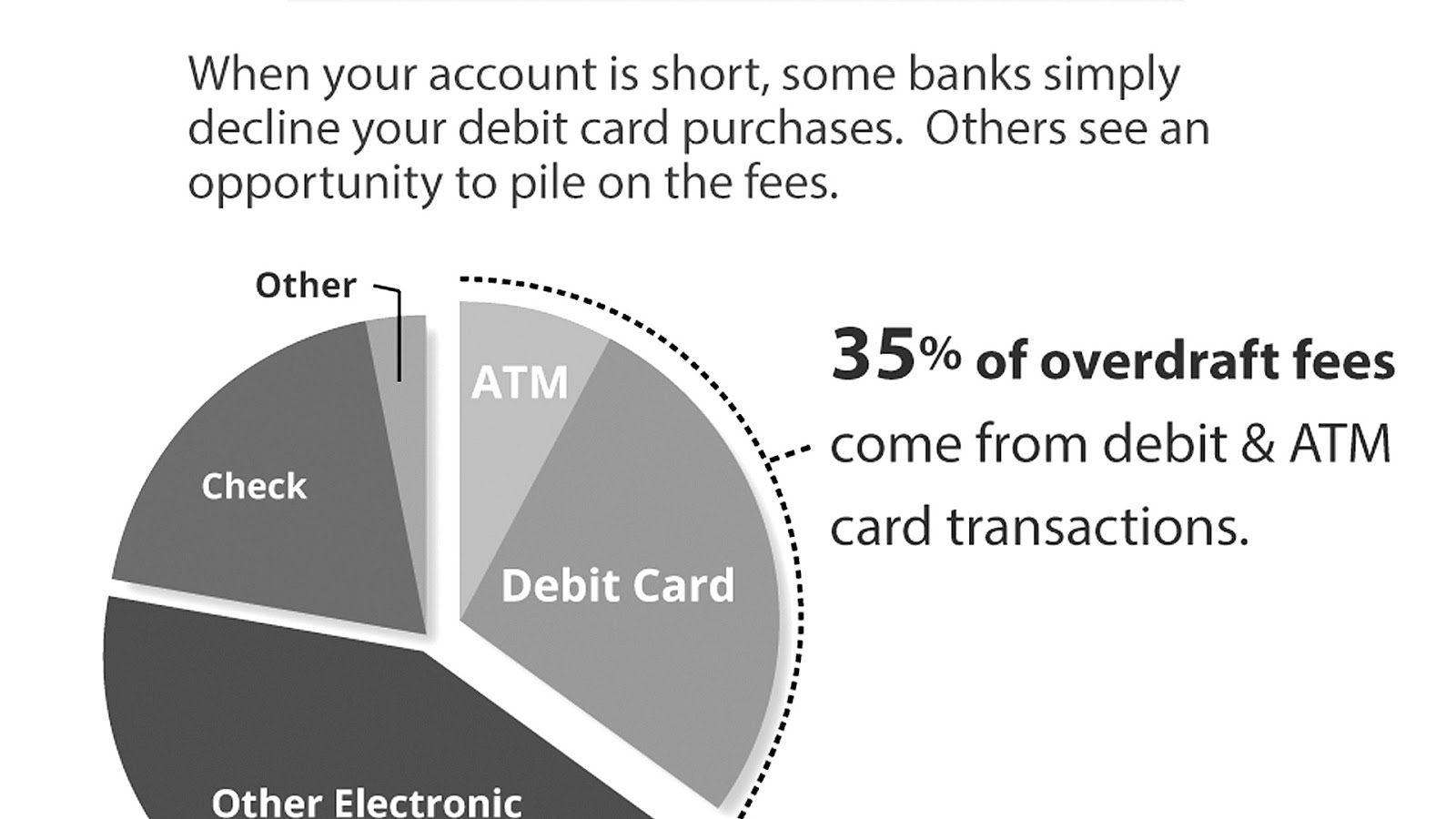

How Much Can You Overdraft Your Checking Account? (Consequences of Overdrawing a Checking Account)How to Fix an Overdrawn Bank Account � Make a transfer to cover the charges � Ask your bank for a refund � Stop using the account � Use these tips to avoid. Your checking account is overdrawn when there's not enough money to cover a payment, purchase or check you write. We may pay overdraft transactions at our. An overdraft occurs when there isn't enough money in an account to cover a transaction or withdrawal, but the bank allows the transaction anyway.

Share:

:max_bytes(150000):strip_icc()/can-checking-account-go-negative.asp-final-1e2da6e358ab4ec2bbaa30e2e54c49ec.png)