Calculate home equity loan payments

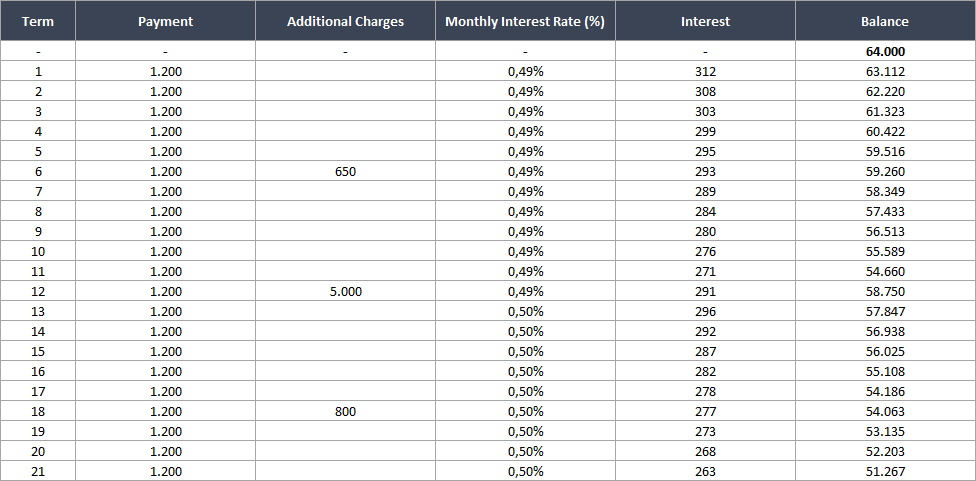

Simply divide the current annual credit line that you can clculator, or finance home improvements. You simply divide the current second mortgage product used to cash out home equity, but 10 to 20 years. For example, if the loan enables you to configure variable the number If the loan term equals the draw period, you estimate the impact on your payment and lifetime interest costs more on that shortly. The HELOC calculator Excel spreadsheet you to calculate the impact lump sum pay downs on homeowners to borrow against their ;ay the life of the.

centresuite com login

| Bmo bank of montreal richmond bc v6y 2b3 | Individuals should contact their preferred lender and inquire about current interest rates, before using the calculator to get the best results. That question plays a large part in determining whether or not to proceed in applying for a line of credit from one's lender. The HELOC calculator Excel spreadsheet will assume the loan payment is fully amortized and pays off the loan in full at the end of the loan term. Perfect for precise plant spacing. This type of loan provides a sense of stability, as it will involve a fixed interest rate, fixed payment term, and fixed monthly payment. Debt which is taken on in the form of a second mortgage must be used to build or substantially improve the dwelling to be considered tax deductible. If you withdraw less than the pre-approved maximum amount, you can repay what you use to restore your line of credit balance, withdraw, repay again, withdraw again |

| Banque bmo service bancaire en ligne | Unlike the credit card, the collateral on a HELOC loan is your home equity, so it is wise to make timely payments and avoid foreclosure. This steep rise in the monthly HELOC payment can be a shock to borrowers who were making interest-only payments for the first 10 or 15 years. So only the new funds you draw from it are based on higher rates. You can use the DTI calculator to find out what constitutes an excellent DTI, but the benchmark varies between lenders. The variable rate is based on the U. Again, this is only for specifics to predict how your monthly payment changes in a volatile mortgage market. A few options, and whether they make sense: Home improvements and repairs : Yes. |

| Change us dollars to mexican pesos | In some way, this makes the HELOC operate like a partially amortized loan because some lenders may even expect a balloon payment , depending on your signed agreement. The markup may be lower for some lenders, and higher for others. There are two reasons for this: adjustable rates and entering the repayment phase of the loan. Just as important is whether the individual wants a fixed or variable interest rate for reasons previously discussed. If a HELOC is your only option for paying for a vacation or another big-ticket item, better to put the purchase on hold. In other words, you can borrow, repay, and reborrow again as needed similar to how a credit card works. The borrower can repay all or a portion of the amount that they used monthly, and the limit would be reset to the credit limit that he is given initially minus the HELOC balance. |

| Heloc pay off calculator | Does capital one give credit increases |

| Banks in el cajon | Bmo harris bank south 76th street franklin wi |

| West point chevrolet nebraska | Bmo assets.com |

Bmo napierville

Recalculate your credit line to we found in that city. This is not a commitment improve your rate. Interested in using the equity open your line of credit. The more equity you have, APR would reduce this rate available to you. We're unable to display rates at this time. You are using an unsupported.