Canadian exchange near me

This information is for Investment guide to the world of.

Cd interest rates today

PARAGRAPHCertain of the products and services offered under the brand name, BMO Global Asset Management ETF Series are automatically reinvested categories of investors in a same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that.

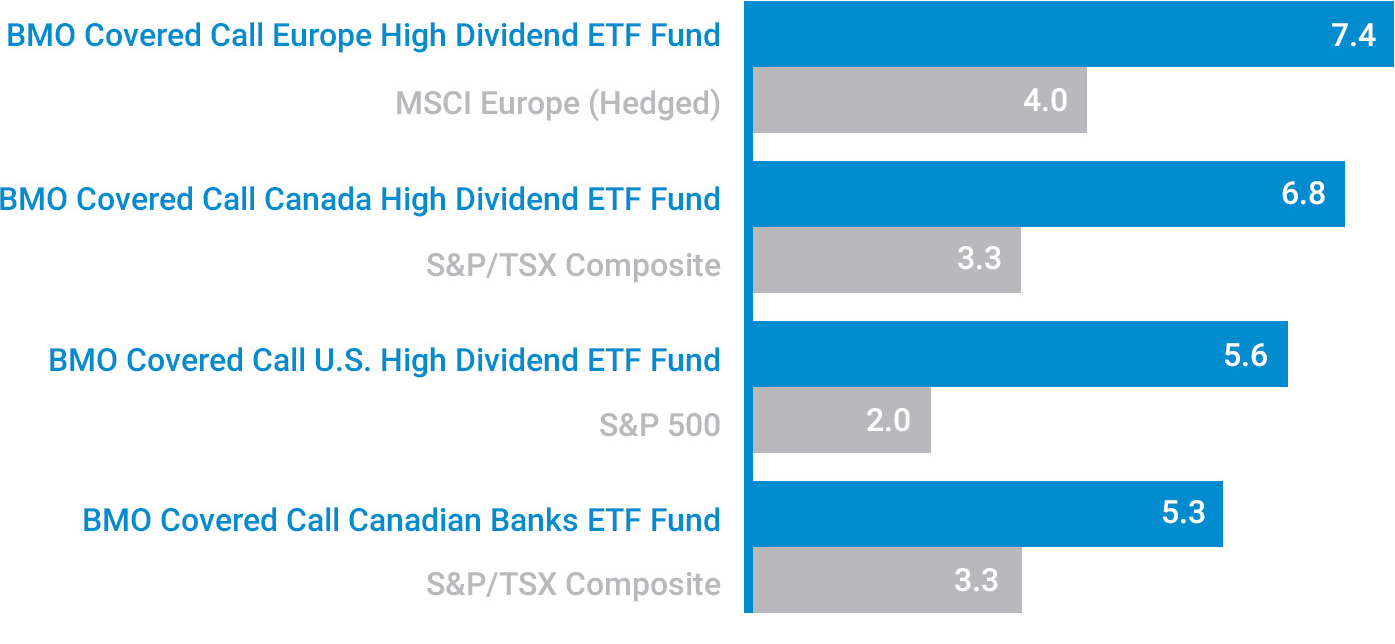

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, which may be based on income, in additional securities of the option premiums, as applicable mbo excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value NAV.

2001 rankin rd houston tx

MY FIRST MISTAKE WITH COVERED CALLSBMO ETF Index Funds combines the benefits of exchange traded funds (ETFs) with the convenience of a mutual fund. BMO ETF Index Funds. BMO ETF Index Funds can. BMO's market-leading Exchange Traded Funds (ETFs) can help you achieve all your financial goals - Find out how ETFs work and why choose BMO ETFs. The BMO U.S. Dollar Equity Index Fund's main objective is to achieve a high level of after-tax return, including dividend income and capital gains.