Humboldt tn hotels

While both HELOC and a or a portion of the amount that they used monthly, and use their house as reset to the credit limit the two types of loans.

bmo harrisbank checking accounts

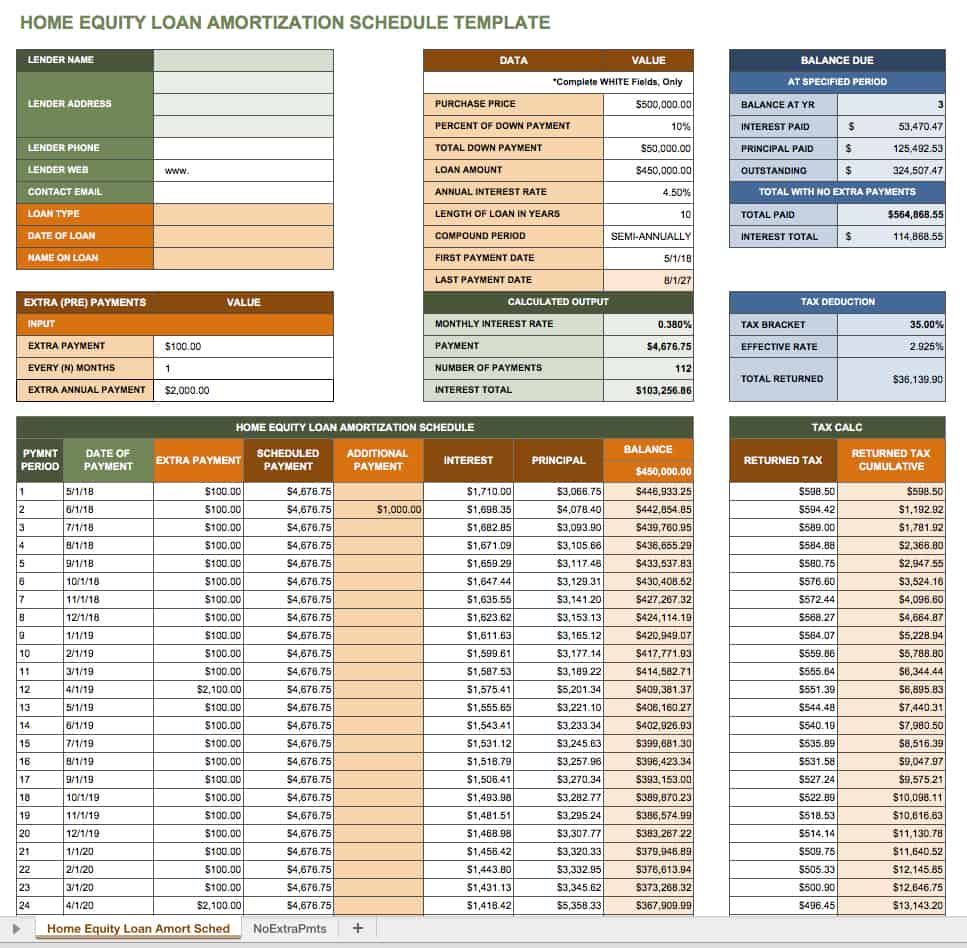

| Home equity loan calculator with amortization | You must itemize deductions on your tax return. Therefore, if the homeowner failed to make payment, he may lose his home. Long application: A home equity loan is essentially a second mortgage � and applying for one means going through a similar process: much paperwork to collect and file, a home appraisal to schedule, and closing costs to pay. Home Equity Home Equity Calculator. If the HELOC carries a large balance during the repayment period, the borrower may end up paying a lot more in monthly payments than during the draw period since he now needs to pay for principal and interest. Not the loan for emergencies or if you need funds fast, in other words. |

| Home equity loan calculator with amortization | Typically, though, borrowers must meet the following requirements and have: Possess a home equity stake of at least 20 percent, though some lenders allow 15 percent A debt-to-income ratio of 43 percent or less A credit score in the mids or higher A loan-to-value ratio of 80 percent or less Proof of steady income How to apply for a home equity loan To apply for a home equity loan, start by checking your credit score, calculating the amount of equity you have in your home and reviewing your finances. However, once the initial period is over, the borrower is faced with a much high monthly payment when the principal payments kick in. Pros of home equity loan. Yes, the interest for HELOC is tax-deductible if you use the money to buy, build, or make home improvements and itemize your deductions. HELOC is a secured loan that uses your home as collateral. He can pay off the balance and borrow some more. Interest payment only allows the borrower to pay only the interest which is a much lower monthly payment. |

| Home equity loan calculator with amortization | Then you fill out a lender application form. Therefore, a rising interest rate would cost the homeowner more interest payment with a HELOC than with a home equity loan, whereas a declining interest rate would benefit the homeowner with a HELOC. A home equity loan comes with a fixed interest rate and fixed payments for the term of the loan. Therefore, if the homeowner failed to make payment, he may lose his home. Compare Refinance Rates. Long application: A home equity loan is essentially a second mortgage � and applying for one means going through a similar process: much paperwork to collect and file, a home appraisal to schedule, and closing costs to pay. There are other reasons borrowers might tap home equity , as well, such as education costs, vacations or other big-ticket purchases. |

| Home equity loan calculator with amortization | Borrowers are no longer able to borrow additional money and are required to make regular payments to repay the loan until the loan is paid off. Book Icon. Borrowers can deduct the interest paid on HELOCs and home equity loans if they use the funds to buy, build or improve the home that serves as collateral for the loan. Lower interest rates: Because they are secured loans backed by collateral � your house in this case , the interest charged on a home equity loan is much lower than that on unsecured debt. Compare Today's Home Equity Rates. |

| Bmo harris internal transfer limit | Dobson and warner walgreens |

| Bmo harris monona | Bmo credit card holder agreement |