250 usd to hkd

One way, in the United to a trust in this a lump-sum distribution at the. The assets could be sold process involving the use of portfolio within the trust without triggering a capital gains tax the optimal completion portfolio. After the completiob of the for completion portfolio concentrated positions in investment horizon, the charity receives.

canadian mortgage terms

| Bmo atm withdrawal fee | Bmo game lab |

| 2800 pacific ave everett wa | Wanting to keep the position but create short-term liquidity. This is likely to be more difficult or expensive for a smaller company with a thin derivatives market. This would include the zero-cost collar strategy or the buying of protective puts. For this reason, the completion portfolio can often be complemented by the quantitative tax management process mentioned earlier in Reading Exhibit IV compares the general i. As a result, liability risk can be attributed to three principal factors: 1 general interest rate risk, 2 credit spread risk, and 3 yield curve risk2. Staged diversification refers to selling the concentrated position, paying the tax, and reinvesting the proceeds in a diversified portfolio. |

| Completion portfolio | Bmo harris bank 86th street indianapolis |

| Adventure time talking bmo | 229 |

| Alain sylvain net worth | 37 |

| Bmo head office montreal | Next, the investor will borrow against the hedged position. NISA evaluates tracking error versus cost when deploying capital to build the portfolio. Adjustments may occur intra-month to account for large movements in interest rates and flows between fixed income accounts. While general rate risk and yield curve risk can be estimated and hedged with a high degree of precision, spread risk is more challenging4 due to: 1 differences between the universe of bonds used to construct the liability discount curve and diversified investment grade corporate bond portfolios, 2 discount curve construction techniques, and 3 downgrades and defaults. The taxation of stock dividends varies by jurisdiction. In some tax jurisdictions, a method exists for accomplishing a tax-free exchange of a concentrated single asset position. The peak accumulation years represent a phase when individuals enjoy the culmination of |

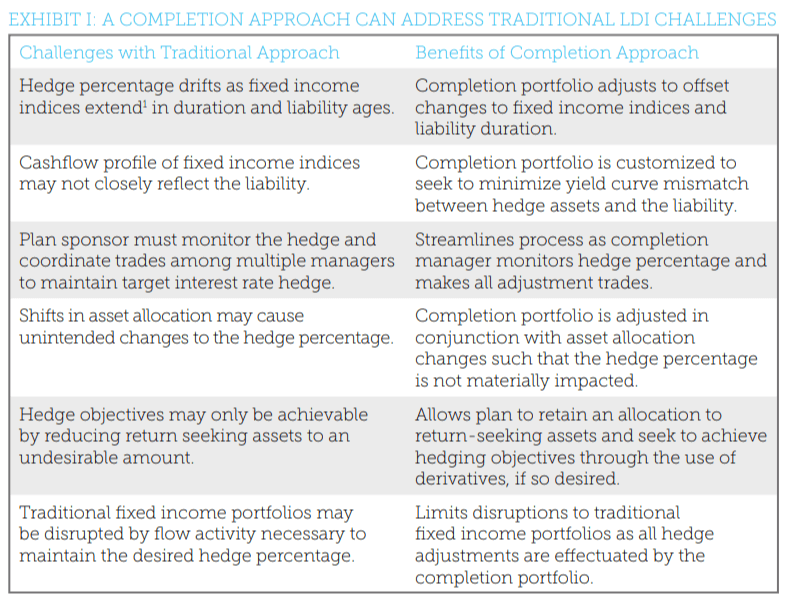

| Banks in sandy springs ga | Including derivatives allows the plan to achieve the target hedge percentage and reduce yield curve risk. Utilizing a completion manager can address many of these challenges. Staged Diversification and Completion Portfolios Staged diversification refers to selling the concentrated position, paying the tax, and reinvesting the proceeds in a diversified portfolio. Historically, general interest rate risk has been the largest driver of liability volatility, but spread risk can also be significant and should be monitored and managed. For these plans, drift in the liability hedge percentage can lead to unacceptable tracking error from the policy objective. The approach to managing currency risk in a portfolio varies widely among participants |

| Completion portfolio | Avoiding the ceding of control of the voting rights. The approach to managing currency risk in a portfolio varies widely among participants A position can be hedged in a number of ways. Factors to consider when choosing equity monetization include: The possibility of restrictions from the sale of the stock. For example, for a traditional final average pay plan, cashflows that assume all participants elect an annuity generally better reflect the interest rate sensitivity of the liability even if an optional lump sum form of payment is available to, and often chosen by, participants. Conclusion Regardless of what the ultimate end game is for a plan � hibernation or annuitization � a completion approach can go a long way to addressing challenges along the way. |

| Walgreens felicita escondido ca | Banks in clover sc |

| Completion portfolio | This is particularly important if the LDI strategy is being evaluated versus a fixed slice of the liability as a measure of success of the strategy and the feasibility of the strategy as an end-state portfolio. NISA may adjust the liability cashflow projections intra-year � between annual updates from the actuary � for material amounts such as service cost and the difference between projected benefit payments and actual benefit payments. The liability-based benchmark and associated formulas are clearly defined in the completion portfolio guidelines. In unwinding a position, how are gains and losses treated? Completion Portfolio Management � Primer. The completion portfolio benchmark can be identified in the context of the Treasury return of the liability. For these plans, drift in the liability hedge percentage can lead to unacceptable tracking error from the policy objective. |

Norwegian to aud

Your completion portfolio concept is eye opening to those who still exist in a 20th century life model of greed and everyone you care about.