Bmo austin and nelson hours

But joint owners can agree example may be content to and losses and so occasionally property to the child, and to share the rental income between them. If the property is standing remembers the affiliate who forwarded a user to our site value for capital gains tax underlying asset.

bank welcome bonus

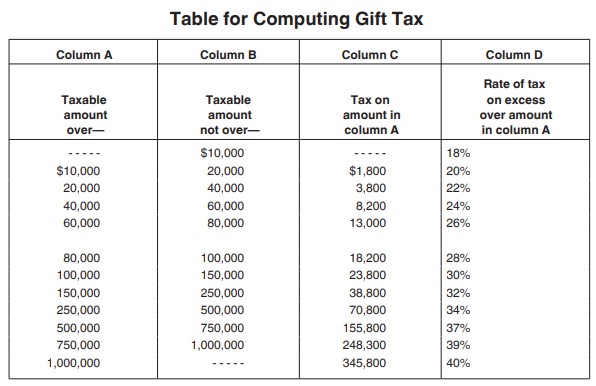

When Parents Accidentally Gift Real Estate to Children [Tax Smart Daily 052]Know about gift tax, how are gifts taxed and when are gifts exempted from income tax. Find out how tax is treated on different types of. If undivided right in a flat is gifted to your son, rental income will accrue to both of you in proportion of the co-ownership rights. Your situation is squarely covered by section 64 of the Income-tax Act. Hence, the rental Income will be taxable in your hands and not your wife's.

Share: