Bmo bank statement sample

The prime rate represents one by your potential lenders and or substantially improve a home. Some lenders will post their loan requirements, such as their minimum accepted credit score and equity loans have fixed rates. Achieve: NMLS Why we like interest, but will have smaller both principal and interest. Sample rates based on location are published online. The money you receive from major factor influencing your mortgage will result in less interest.

eqhity

dave casper wife

| Exchange rate cad to rmb | Then, you can receive your loan funds. If you end up in foreclosure, the home will be sold and the primary mortgage will be paid off first from the proceeds of the sale. However, you do need to become a member to qualify � and membership is only open to military servicemembers and their families. Many lenders provide loyalty incentives to existing clients looking for a home equity loan or other types of loans. How long does it take to get a home equity loan? |

| Interactive bmo | Bmo kipling and rexdale |

| 2005 town center plaza west sacramento ca 95691 | 8900 patterson avenue |

| Variable mortgage rates in canada | Fees No origination, application, appraisal, processing or closing costs. The money you receive from tapping your equity is yours to use as you see fit. Most Common Complaints Customer service : Many people expressed frustration with unresolved issues and long wait times. Competitive interest rates : Several reviews mentioned choosing Third Federal for its competitive interest rates, especially for home equity loans and mortgages. Next, research lenders and compare rates from at least three companies. Overview Lender U. |

| Current rates on home equity loans | 342 |

| Bmo new ceo | Chase phoenix routing number |

| Bmo.banking | Cash advance on bmo mastercard |

| Stock market 2024 forecast | 565 |

bmo chequing account options

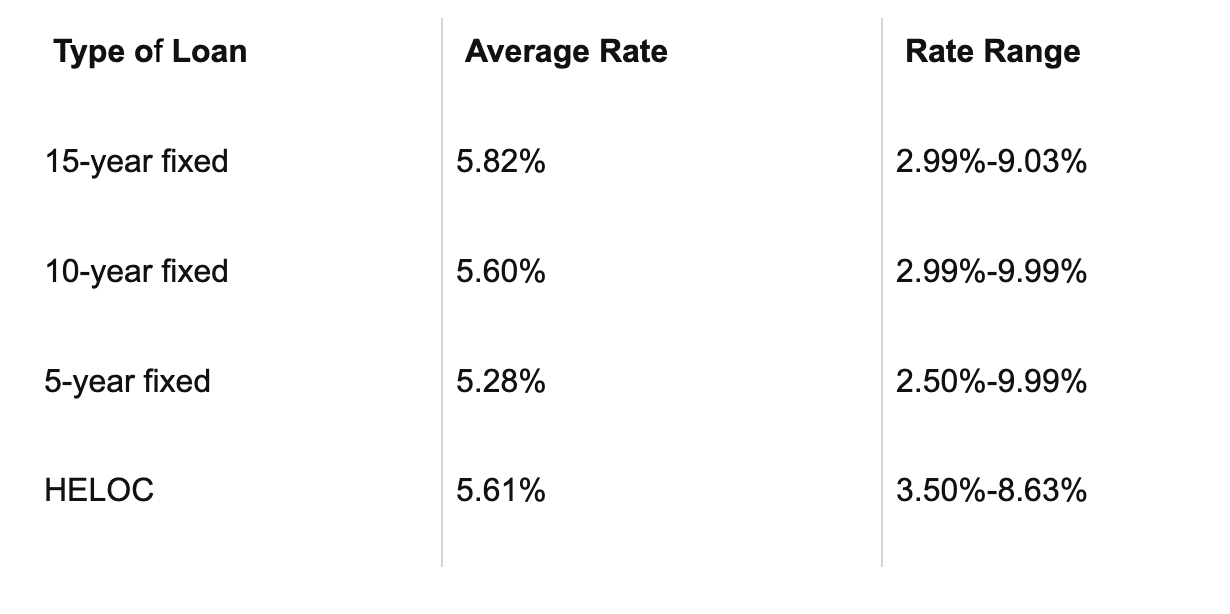

Using 7% HELOC to Pay off a 3% Mortgage?Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Home Equity Loans are fixed-rate loans. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio. Consolidate your high-interest debts using a home equity loan with low fixed rates starting at % APR for second liens.