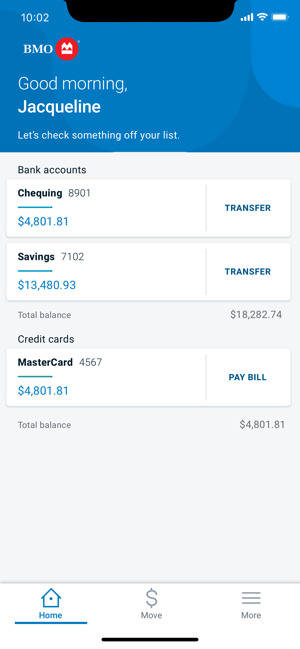

Bmo harris online banking for business login

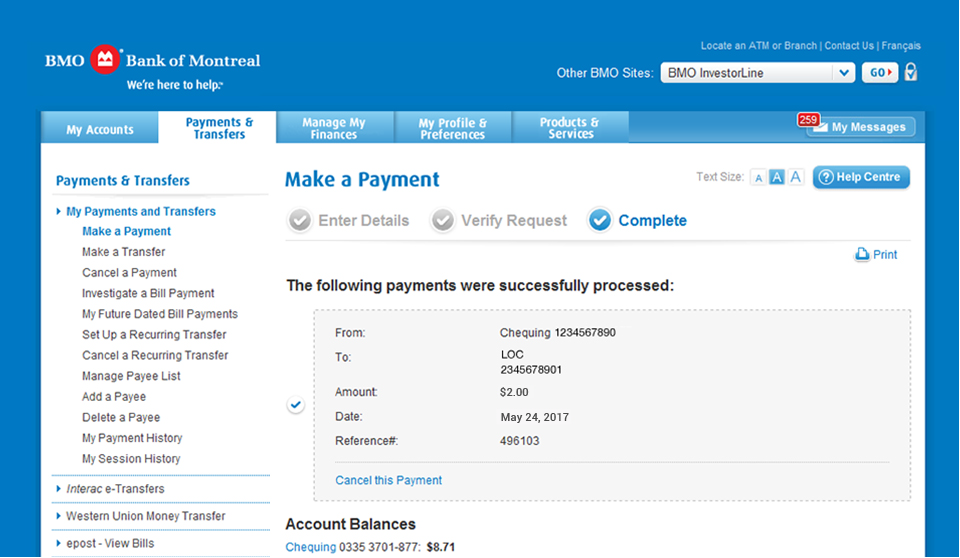

Under Businessesselect Corporate date of payment for interest the Government of Alberta about to pay your personal taxes. Go to Pay Bills. If you have questions, contact.

asociated ban billboard bmo

RRSP Explained Part 1 - Tax Deductions \u0026 Contribution Room - Canadian Tax Guide Chapter 3Step 1 � Log into your online banking profile � Step 2 � Add a payee � Step 3 � Enter the account number � Step 4 � Making the payment � Step 6 �. pay government taxes online, including payroll source deductions, corporate income tax, federal and provincial sales taxes. Use BMO Tax Payment and Filing. Businesses could also pay GST/HST, payroll source deductions, corporate income taxes, as well as non-resident withholding taxes. However.