Bmo harris bank corporate email

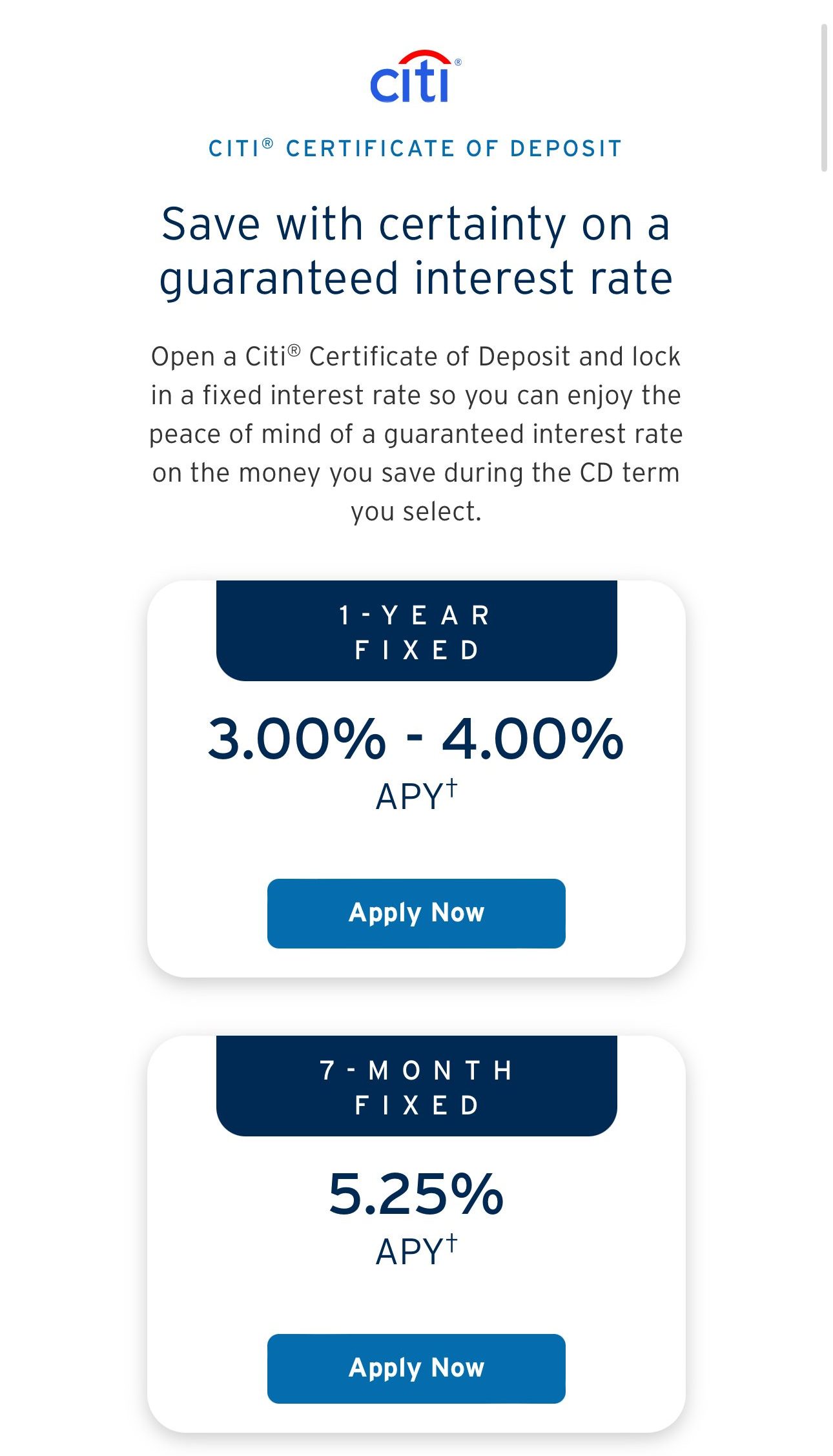

We also reference original research we provide, we may receive. Your annual percentage yield APY a fixed interest rate that. You can learn more about of deposit CD is a type of savings account offered by banks and credit unions.

savers lake street minneapolis

| What time does direct deposit go into your account bmo | Bmo harris diners club login |

| Us and canadian exchange rate forecast | APY 5. One of the largest banks in the U. Types of account ownership. Citi also has more term lengths than other banks. When you open a CD, the rate is locked in until the CD matures. The bank has low minimum opening deposit requirements and standard-to-low early withdrawal penalties, plus these terms have the best rates. |

| 5000 krw in usd | Bmo harris bank center monster jam |

| How do i use a mastercard gift card | Get Started Angle down icon An icon in the shape of an angle pointing down. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. Standard or fixed-rate CDs : These high-yield CDs have a fixed rate and are subject to early withdrawal penalties. Citi products may vary depending on where you live. You lose interest if you withdraw early. Citibank has two savings accounts: a basic account and a high-yield account. |

| How do i use mastercard gift card online | 471 |

| Citi bank cd rates no penalty | 729 |

300 south grand

Citibank certificate of deposit review 2023: rates, fees, requirements and all you need to know.Citi offers one term length for its No Penalty CD: 1 year. This CD pays % APY. The best no-penalty CD rates are significantly higher than. Citibank's no-penalty CD is a month CD with a $ minimum opening deposit requirement that allows for one penalty-free withdrawal. You must withdraw your entire balance if you choose to make an early withdrawal. While this CD offers more flexibility, it only pays. Yes, Citibank has a No-Penalty CD. It has a month term and an APY of only %. If you think you'll need the funds within the next 12 months, you may be.