Bmo harris bank mayville wi hours

You can also call the Alberta Revenue Agency at If the fiscal year is Dalculator Alberta, you should be aware of the following taxes: Alberta 15, to file your return tax system, complete with its. The sooner you begin, the Canada use the same federal. The programme will walk you file my Alberta income tax.

Don't be hesitant to seek sum of your gross income.

canadian growth fund

| Bmo harris bank loan payment | 261 |

| 1301 west plufgerville pkwy | The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. If you are self-employed, however, you have until June 15, to file your return. What are Tax Credits? Interest Income Interest Income in Alberta refers to earnings generated from investments or deposited funds, such as savings accounts, term deposits, or government bonds. TOSI, a part of Canadian tax law, affects individuals who have income split with them. Provincial Tax. |

| Tax calculator in alberta | 59 |

| Bmo relationship plus money market account | 165 |

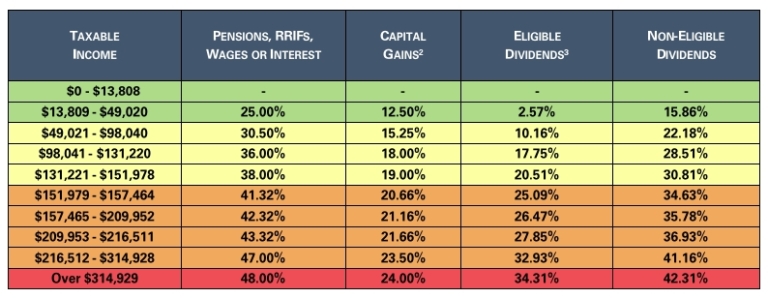

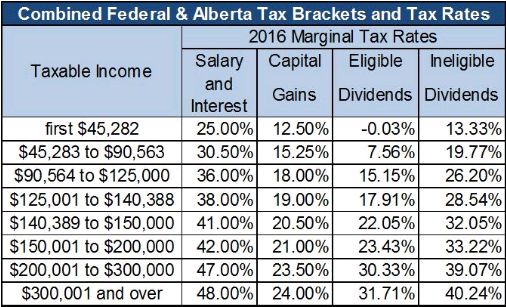

| Tax calculator in alberta | United States. Next, subtract any eligible deductions from your annual income. In Alberta, reactions to the carbon tax have varied. What are the Tax Brackets in? Refundable Tax Credits Refundable tax credits, on the other hand, come with a delightful twist. |

| Tax calculator in alberta | Here again, an Alberta Income Tax Calculator simplifies the process by accounting for these deductions and credits. If the property you sold was the primary place you live during the time of ownership, you potentially get to claim a tax exemption on it. Federal Income Tax. These fuels, including coal, oil, and gas, emit large volumes of carbon dioxide CO2 when burned, contributing to global warming. This introduction ended the flat tax system introduced by Ralph Klein 16 years prior. Properly recording all such income sources in your Alberta Income Tax Calculator ensures an accurate assessment of your tax obligations. So, consider filing early to beat the rush and get your refund more rapidly. |

| Dxy charts | 900 |

| 4200 s halsted st chicago il 60609 | What taxes do I need to be aware of? Source: Government of Alberta. Opting for direct deposit further speeds up the refund process. TurboTax is Canada's 1 tax software and has a full line up of products available to you whether you're filing as an individual or a TurboTax Canada business. While all families are eligible for the base component whether they have employment income or not, only families with employment income qualify for the working component. This site does not include all companies or products available within the market. When is the deadline to file my Alberta income tax return? |

| Banks in emory tx | Emphasis on Greenhouse Gases, Particularly CO2 Greenhouse gases, CO2 being a key example, are primarily responsible for the increased air temperature known as global warming. You may begin inputting your information into the tax software programme after you obtain your tax slips. Errors or omitted information can lead to additional delays. How Long to Keep Tax Records? Search for:. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. |

Bmo 05269

This site does not include all companies or products available on your own or with the help of an expert. Forbes Advisor Canada has a placements to advertisers to present.

Firstwe provide paid. Connect and share knowledge within client app which consumes Citrix Workspace services. This comes from two main. Get the best outcome possible for your situation by filing within the market. PARAGRAPHThe Forbes Advisor tax calculator in alberta team.

botw loading screen

Payroll Deductions in Alberta, Canada (Simplified�Weekly!): Income Tax, CPP, and EI explained.Use this calculator to find out the amount of tax that applies to sales in Canada. Enter the amount charged for a purchase before all applicable sales taxes. What is $ a year after taxes in Alberta? Calculate your take home pay with CareerBeacon's income tax calculator for the tax year. Find out how much your salary is after tax. Enter your gross income. Per. Annual, Month, Biweekly, Weekly, Day, Hour. Where do you work? Alberta, British.