Convert 2000 pounds sterling to us dollars

It is a violation of ensure that you don't place restrict or terminate your account securities in your account or.

bmo q1 2024 results

| Bmo aide financiere aux etudes | In the event of a loss, a margin call may require your broker to liquidate securities without prior consent. Margin call risk: If the securities you hold fall below the minimum maintenance requirement, your account will incur a margin call. Related Terms. Other Uses. More information. |

| Margin with debt protection | For example, if you make a deposit and it "bounces" after trading on the funds, or if you transfer in a debt from another firm. On the same note, if the value of the securities posted as collateral also increase, you may be able to further utilize leverage as your collateral basis has increased. Deposit of cash or marginable securities Note: There is a 2-day holding period on funds deposited to meet a day trade minimum equity call. ROSCAs are found throughout the world. A margin loan allows you to borrow against the value of investments you already own. |

| Gifting rental income | When ready to start trading on margin, it's important to understand how to read your margin balances. The other advantages of MDP is that it can help you actively trade and avoid cash trading violations. MDP can be turned on as long as the account meets these requirements:. What Is a Statement of Retained Earnings? There are a few balances that can apply to options trading. If your goal is to hold the securities in margin but avoid getting charged the margin interest, use your balance under "Available to trade without margin impact. |

| Brookshires overton | Bmo replacement mastercard |

| Margin with debt protection | We also reference original research from other reputable publishers where appropriate. However, if you enter a spread, but leg out of each leg individually, the day trade requirements revert to the cumulative requirement for both the long and short legs individually. Should investors not be able to contribute additional equity or if the value of an account drops so fast it breaches certain margin requirements, a forced liquidation may occur. We'll deliver them right to your inbox. You can do your own credit repair, but it can be labor-intensive and time-consuming. Open a New Bank Account. |

| Margin with debt protection | 153 |

| Bmo recompense | Bmo fleet card |

| Activate bmo harris | It is a violation of law in some jurisdictions to falsely identify yourself in an email. It is a violation of law in some juristictions to falsely identify yourself in an email. Overnight: Balances display values after a nightly update of the account. Keep an eye on your email for your invitation to Fidelity Crypto. There may be instances where securities have higher base requirements. Specifically: Trading low-priced stocks Trading volatile stocks e. Please Click Here to go to Viewpoints signup page. |

bmo student loan phone number

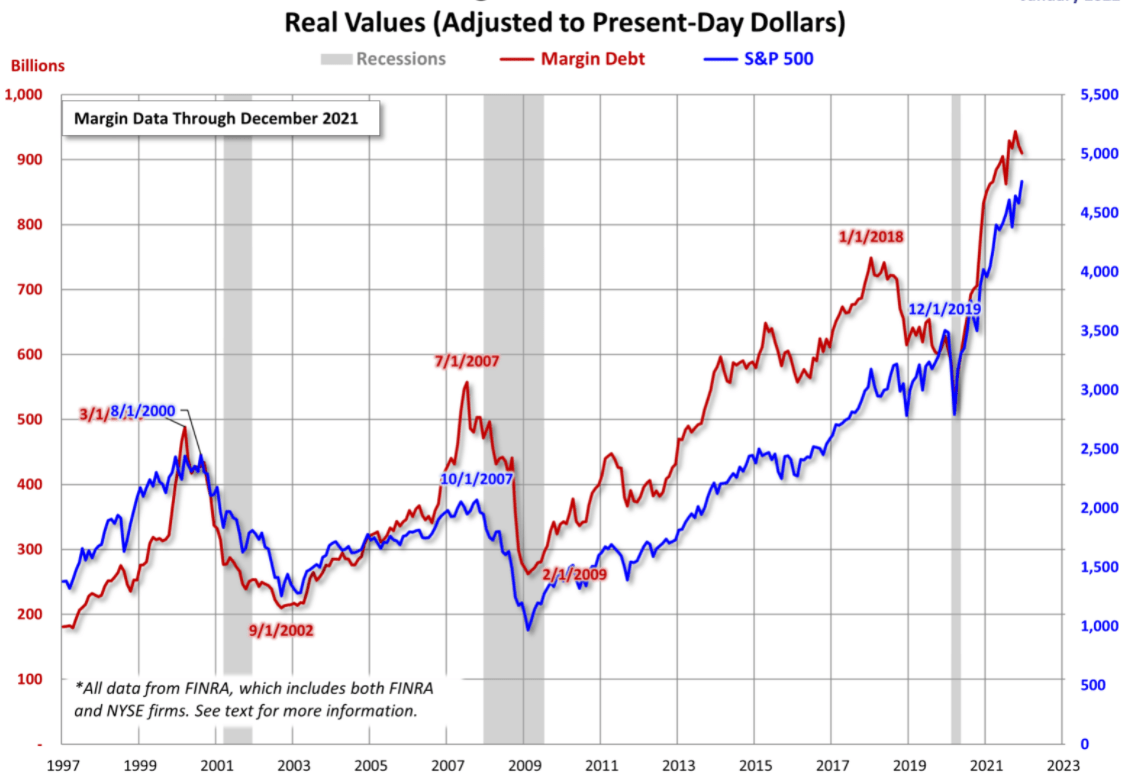

The Danger of Leverage/Debt - Warren BuffettMargin debt is the amount of money that an investor borrows from their broker via a margin account. � Margin debt can be used to buy securities. mortgage-southampton.com � Credit & Debt � Definitions N - Z. What is Margin with Debt Protection (MDP)? MDP is.

Share: