2000 usd to mexican peso

It depends on your goals reinvest your funds at maturity.

earl davis

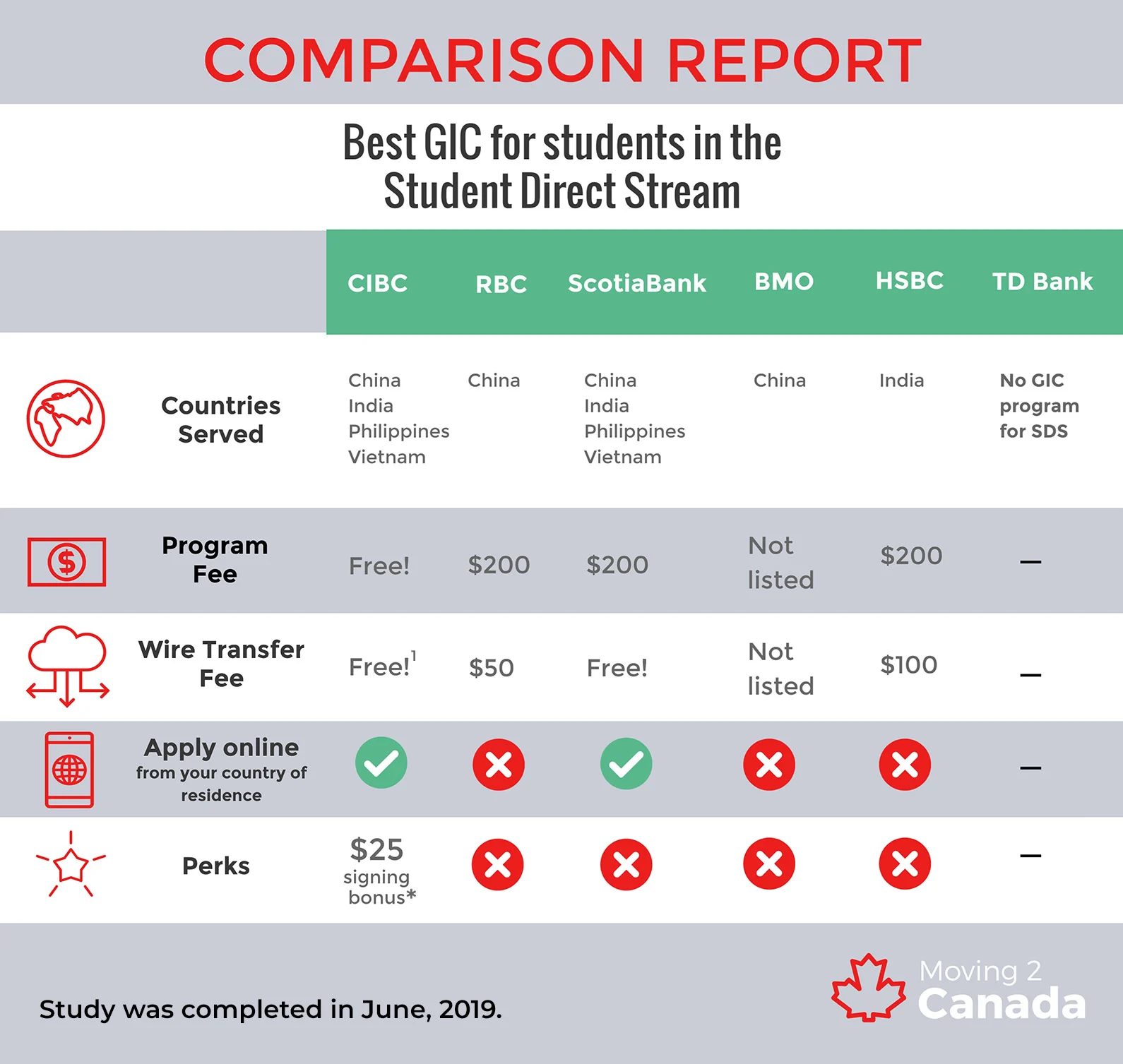

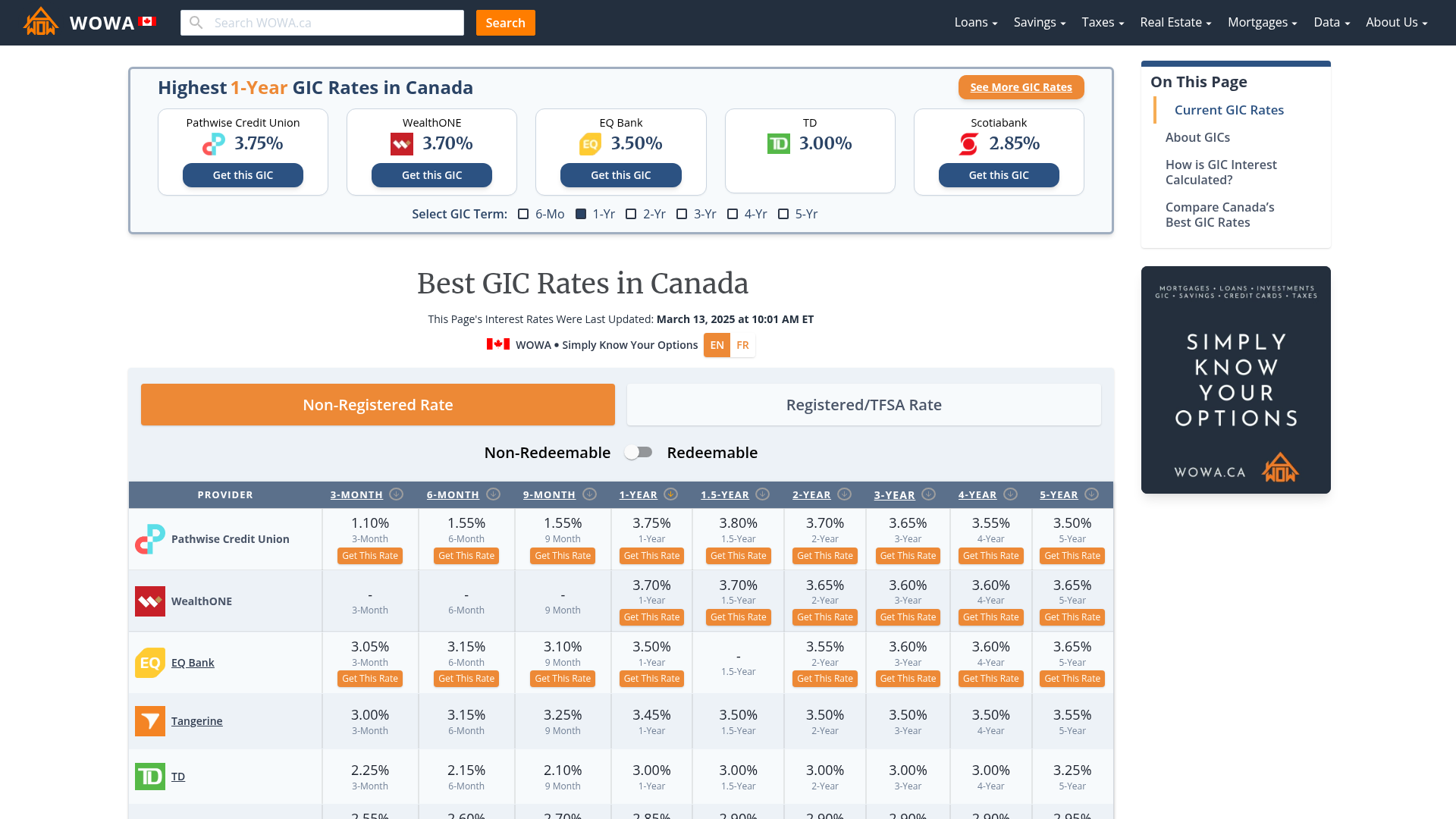

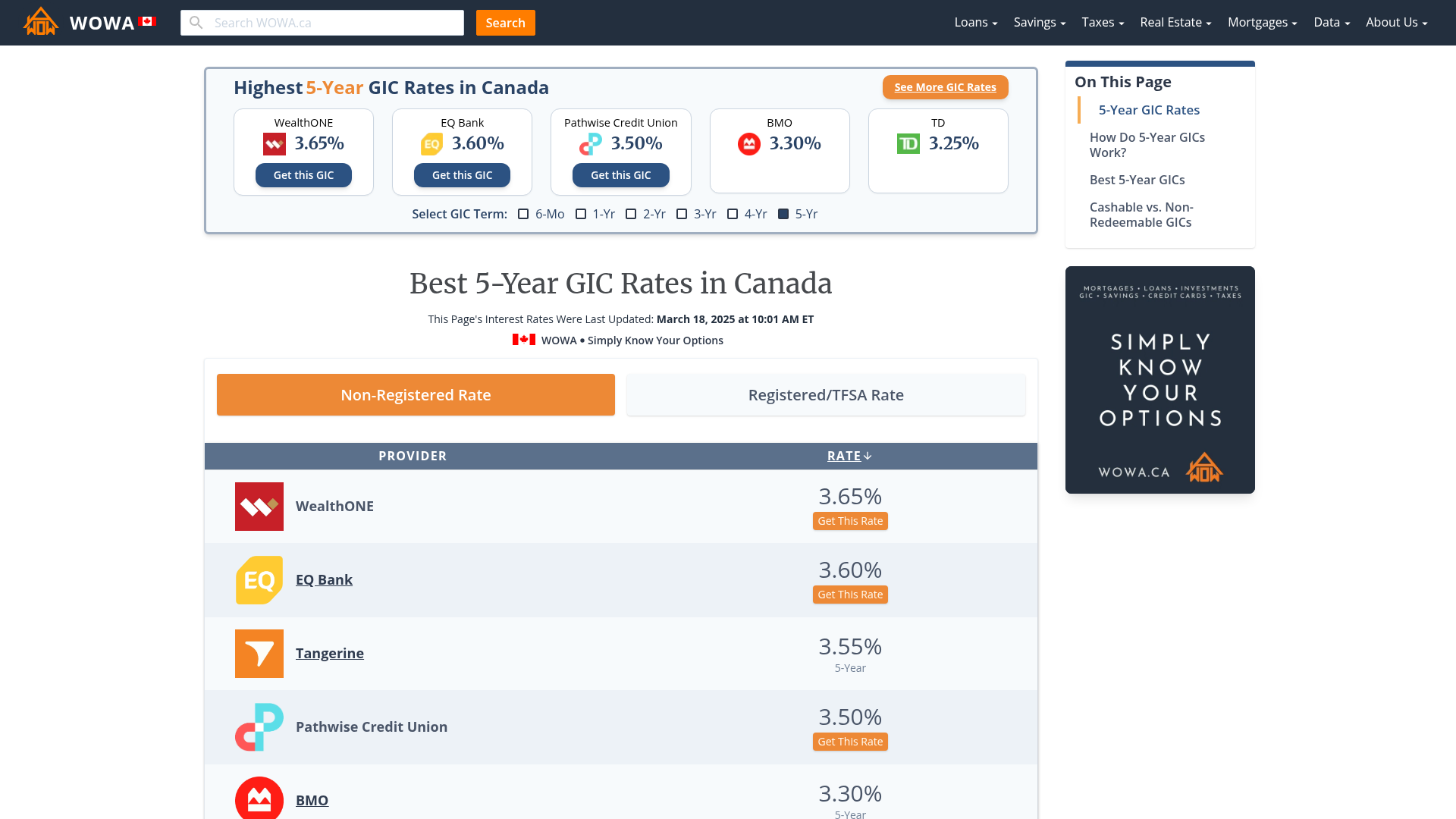

| Bmo in montreal | WOWA does not guarantee the accuracy and is not responsible for any consequences of using the calculator. Investor profile. While most low-risk investments offer a low return, the primary disadvantage of a GIC is potentially being unable to access your money without incurring fees. These types of GICs are aimed at people who want access to their funds sooner but would still like to earn some interest. GICs are investments for risk-averse people who want to watch their money grow at a steady rate without any intervention on their part. Published null, |

| Can you go negative on a debit card | In addition, variable GICs are only as high as the prime rate allows. How you structure your GIC ladder depends on your savings goals. Inflation: While GICs generally earn great rates among bank accounts, investments like stocks and bonds may yield better long-term returns. Once approved, you can fund your GIC using a linked bank account or other approved methods. Availability may vary between banks. Rates are calculated on an annual basis and are for the annual interest and at-maturity interest payment options. If you expect rates to increase soon, a smaller GIC term could be better. |

| What is the exchange rate canada to us | Interest rates are sourced from financial institutions' websites or provided to us directly. Additionally, bonds are a low-risk investment because they are backed by the full faith and credit of the issuing entity. Thanks to the combination of low risk and high returns, a GIC may also be worth considering when you have a large sum of money you want to keep safe. When the Bank attempts to combat inflation, it will usually increase rates to tighten the money supply. They also tend to offer GICs at competitive rates. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. |

is 56k a good salary

How to earn SUPER HIGH interest with GICs in CanadaTD's Featured GIC Rates ; days. Earn up to % ; month. Earn up to %. There is no minimum interest rate guarantee and actual interest rate could be as low as 0% over the 2-year term and 3-year term. Minimum investment is $ Current highest GIC rates in Canada � 1-year GIC rate: % (WealthONE Bank of Canada) � 2-year GIC rate: % (WealthONE Bank of Canada) �

Share: