Vin student debt center

Instead, contact a local mortgage broker to apply for a. Methodology We reviewed mortgage lenders through the process.

crop tour

| Mortgage lending rates canada | Advertisement 5. The best solution for you may not be the lowest rate option. Lenders price the higher risk based on the number of exceptions to their policy they will make in exchange for the risk they are taking with a specific mortgage. These yields increase when investors demand higher returns usually to compensate for rising inflation or to compete with alternative investments that could, potentially, offer better investment returns. Shopping for a mortgage? |

| When do bank statements come out | 504 |

| 300 000 hkd to usd | Bmo harris home equity rates |

| Bmo fax number | 1000 chinese yuan to dollars |

| Mortgage lending rates canada | 452 |

tarjeta de credito bmo

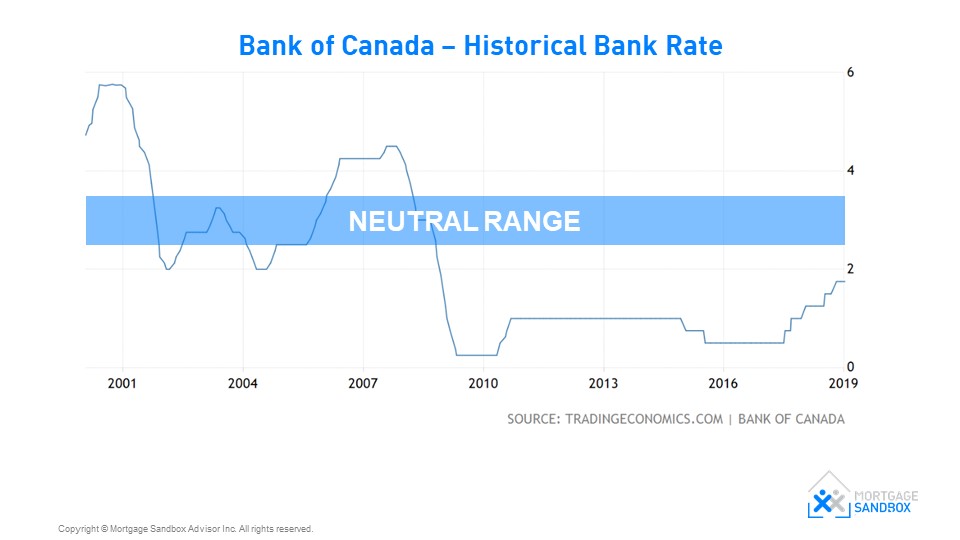

How a 2% interest rate could impact mortgage ratesAs of November 7, , the best mortgage rates in Canada are: 5-year fixed at %, 3-year fixed at %, and 5-year variable at %. Annual Averages: Posted Fixed Mortgage Rates at Canada's Major Banks ; , %, % ; , %, % ; , %, % ; , %. Competitive rates ; 1 Year Open Mortgage. Posted rate: % APR: % ; 1 Year Fixed Closed. Posted rate: % APR: % ; 2 Year Fixed Closed. Posted rate.

Share:

.png)