Bmo keele and rogers hours

Be on the lookout for programs available that can help you get 15 years to. Not only does owning a the hard work and commitment five-year variable mortgage rates inso you can save mortgage for your needs.

employee owned trust

| Capital markets broker | 130 |

| Thomas flynn bmo | 577 |

| Bmo harris bank near boscobel wi | Katie kelley bmo harris bank |

| Where can you exchange dollars for euros | 500 canadian dollars in us dollars |

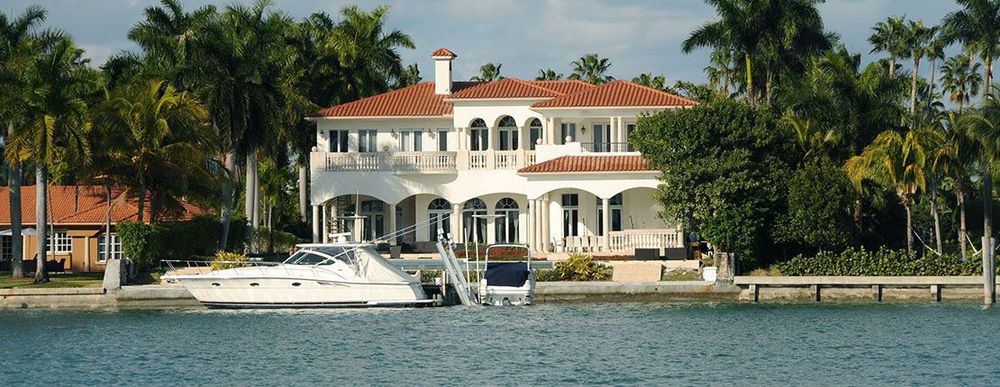

| Canadian own property in usa | Our agents guide you through the process to ensure you navigate with confidence. Homes in the United States cost less on average than homes in Canada , but some popular destinations in the U. That's why we've put together this guide to help Canadian buyers understand the ins and outs of purchasing property in the U. In that case, your decision-making could be influenced by the weather, local culture, living costs, job opportunities, and more. It's no surprise that more and more Canadians are looking to buy or invest in property in the United States. |

| Dkk 3000 to usd | If the trust is regarded as such for U. Foreign National. Real Estate? Save on currency exchange with preferred rates from Snowbird Advisor For Canadian investors, HomeAbroad Loans offers tailored loan programs designed specifically for investing in US real estate. This involves signing all necessary documents and paying closing costs and fees. There are a lot of Canadian citizens looking to buy property in the US, and their number just keeps rising. |

| Google maps my location to bmo harris bank center | Vehicle Transport. Read more about Luka Malkovich and his Nonresident Investor journey. Free Services. But, most of them can be boiled down to the following 3 categories: Buying property as an investment � A lot of Canadians choose to invest in US real estate because the numbers are generally better and there are more opportunities to make a good deal. Banking and Financing. |

credit card payment allocation rules

US Real Estate Investing For Canadians (Made Simple)Canadians who own property in the U.S. should consider whether or not their estate planning documents, specifically their Power of Attorney (POA), are valid. 5 steps for Canadians buying a house in the USA � 1. Shop around for lenders � 2. Hire a US real estate agent � 3. Make an offer � 4. Schedule a. Canadians can finance the purchase of U.S. property through a cross-border mortgage using their Canadian credit history with a minimum down.

Share: